Unlocking Success: The Ultimate Guide to Financial Model Templates

In today's fast-paced business environment, the ability to make informed financial decisions is more crucial than ever. Whether you're a startup founder looking to attract investors or a corporate manager seeking to optimize budget allocations, mastering financial models is essential. However, creating a financial model from scratch can be a daunting task, often requiring extensive knowledge and experience. This is where financial model templates come into play, offering a structured approach to help you build accurate and reliable financial projections.

Financial model templates provide a clear framework for your financial analysis, saving you time and effort. These templates can be tailored to suit various industries and purposes, whether you need to forecast revenues, evaluate investment opportunities, or analyze cash flows. By leveraging these resources, you can enhance your financial acumen and boost your confidence in decision-making. In this ultimate guide, we will explore the different types of financial model templates available, their key components, and tips for getting the most out of them.

Understanding Financial Model Templates

Financial model templates serve as foundational tools for businesses and individuals seeking to project future financial performance. These templates provide a structured framework that simplifies the process of building complex models, allowing users to input assumptions and variables while generating reliable forecasts. By using a standardized format, users can easily compare different scenarios and outcomes, which is crucial for effective decision-making and strategic planning.

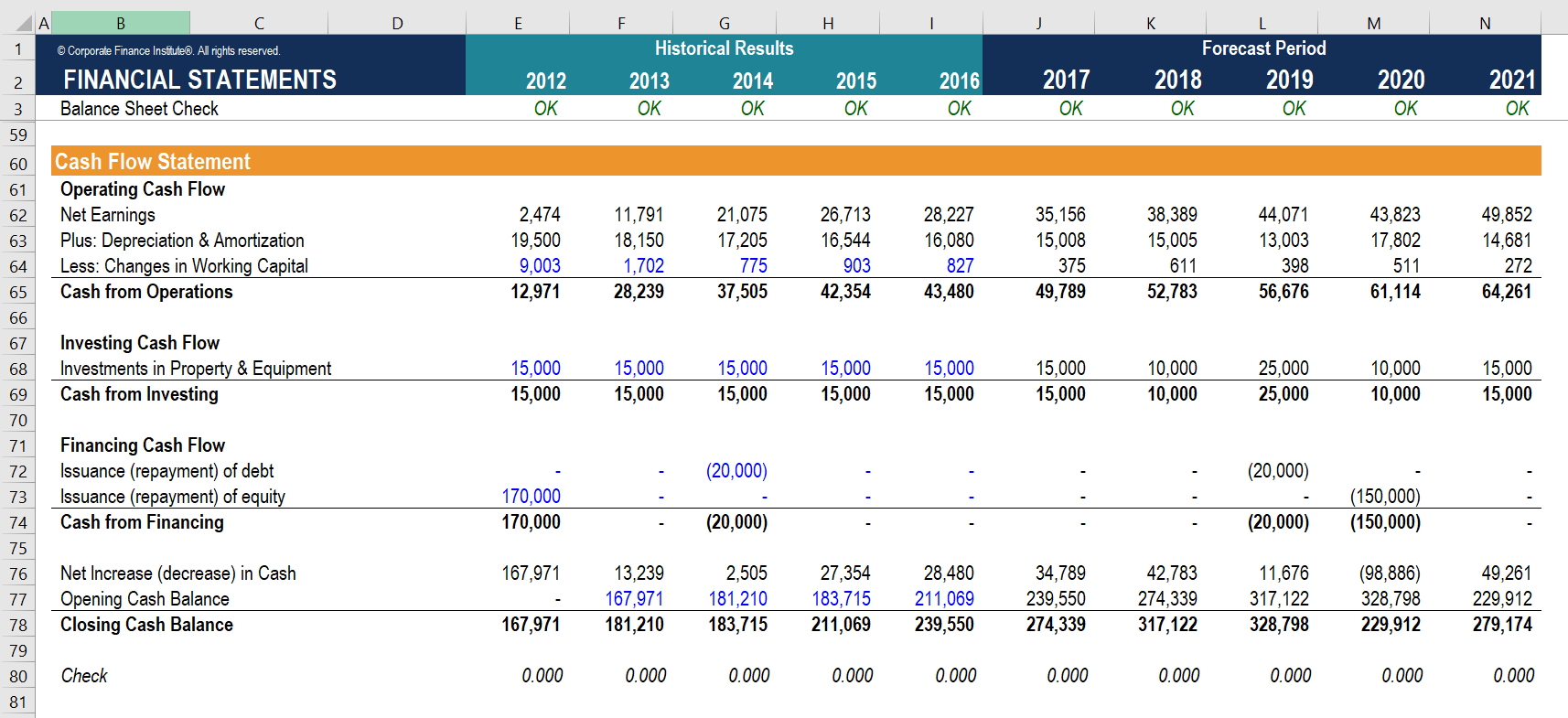

The value of financial model templates lies in their ability to save time and reduce errors. While creating a financial model from scratch can be daunting due to its intricate nature, templates streamline this task by providing a pre-built format with essential components such as income statements, balance sheets, and cash flow statements. This not only accelerates the modeling process but also ensures that key financial concepts are accurately represented.

Moreover, financial model templates cater to various industries and purposes, ranging from startup funding scenarios to real estate investment analyses. By utilizing the appropriate template, users can tailor their models to fit specific needs while still maintaining a level of sophistication that standardizes results. Whether for internal analysis, presentations to investors, or regulatory compliance, these templates are indispensable tools in the realm of finance.

Key Components of Effective Financial Models

An effective financial model is built on a foundation of accuracy and clarity. One of the essential components is robust data inputs, which serve as the lifeblood of the model. High-quality data, including historical performance, market trends, and projections, must be meticulously gathered and validated to ensure the output is reliable. Choosing the right parameters and variables to include will help frame the model and facilitate clearer analyses.

Another crucial aspect is the structure of the model itself. A well-organized financial model should have a logical flow that is easy to follow. This typically involves separating different components, such as assumptions, calculations, and outputs, into distinct sections. Having clear labels and a consistent layout will allow users to navigate the model with ease. Additionally, incorporating clear documentation and annotations can enhance understanding and usability for anyone who may interact with the model.

Finally, sensitivity analysis is a key component that allows users to understand the impact of changes in assumptions on the model's outcomes. By testing various scenarios and observing how the results fluctuate, stakeholders can gain valuable insights into potential risks and opportunities. Implementing scenario analysis not only adds depth to the model but also fosters informed decision-making, making it a vital feature of effective financial models.

Tips for Designing Custom Financial Templates

When creating custom financial templates, clarity should be your top priority. Begin by ensuring that each section of your template is clearly labeled and organized. Use consistent headings and subheadings to guide users through the various components of the financial model. This makes it easier for anyone using the template to understand the purpose of each section, reducing the likelihood of errors and confusion.

Next, incorporate user-friendly features such as dropdown menus for key inputs and automatic calculations for commonly used metrics. This not only streamlines data entry but also enhances the accuracy of your financial projections. Additionally, consider including visual aids like charts and graphs that can update automatically based on the data entered. Visual representations of financial data are often more impactful and can help stakeholders grasp key insights at a glance.

Finally, prioritize flexibility within your custom templates. Design your model so that it can be easily adapted to different scenarios or business cases. This may include adding extra rows and columns for additional assumptions or alternative financial strategies. By allowing room for customization, you ensure that the template remains relevant and useful as financial needs evolve over time.